what is that fair share? 10%, 30%, 50%?

an remember its taxed again as income to the stockholders after dividends

IMO, a profitable company should pay 25-35% Corporation Tax

Upvote

0

what is that fair share? 10%, 30%, 50%?

an remember its taxed again as income to the stockholders after dividends

We cross into the definition of "profitable" here though. What if the company is turning a profit, but after your imposed tax they would not be? Just playing devil's advocate here.IMO, a profitable company should pay 25-35% Corporation Tax

When the wealthy and businesses use loopholes to get millions (billions) from the government they are 'smart capitalists' but when some loser gets a few thousand because of a loophole he's the scum of the earth.

I'm going to go ahead and say it...I bet more then half the people getting food stamps are scamming the system one way or another.

tax money does not belong to the govt....... they take it from the people/companies............ if a company pays less that doesnt mean I have to pay more......... it means the govt has to SPEND less

That's an interesting way to look at it. I never considered this. Now I truly wonder what the actual statistic is.I'll bet they are three times as many people eligible for food stamps who don't take them than as there are people who are scamming the system to get them.

I'm going to go ahead and say it...I bet more then half the people getting food stamps are scamming the system one way or another.

Pretty hard to cite facts. If there were citable facts, laws would be changed as a result.Is that your opinions or can you cite facts?

No, it means the government has LESS to spend. So they have to RAISE taxes on someone else or borrow the money and increase the deficit. Alternatively they could cut spending, but then who would bail out the corporate banks, insurance companies and auto makers?

If a corporation (or a rich individual ...) pays less tax, where does the money needed to run the government, the country, finance multiple wars as well as pay for social services and corporate subsidies (often to the very same highly profitable corporations that didn't pay any taxes in the first place) come from?

YOUR POCKET. The Bush tax cuts added $2.8 trillion to the deficit. That's money the government borrowed (that effectively went straight into the pocket of billionaires) that YOU have to pay back.

No, Bush's spending is what caused the deficit. Revenue for 2003-2007 was the highest in U.S. History. It's not a revenue issue we have it's a spending problem. Our current budget deficit for the year is equal to the entire networth of U.S. Billionaires, it's not mathematically possible to tax our way out of this...

You want facts?

"According to the Government Accountability Office, at a 2009 count, 3.53% of food stamps benefits were found to be overpaid, down from 7.01% in 1999. A 2003 analysis found that two-thirds of all improper payments were the fault of the caseworker, not the participant."

source: Wikipedia

I take back what I said before.

I'll bet they are 10 times as many people eligible for food stamps who don't take them than as there are people who are scamming the system to get them.

congressional spending, remember all spending bills must originate in the house of representatives. they can take the presidents advice, but they have to start it

Of course you are correct but the final say in the approval of those bills lies with the Pres. And Bush was an unapologetic spender, though his spending is dwarfed by the last 2 years.

No, Bush's spending is what caused the deficit.

It's not a revenue issue we have it's a spending problem. Our current budget deficit for the year is equal to the entire networth of U.S. Billionaires, it's not mathematically possible to tax our way out of this...

Is that your opinions or can you cite facts?

Pretty hard to cite facts. If there were citable facts, laws would be changed as a result.

Partially correct. We had a deficit before, we've had 10 years ($3 trillion so far) of wars, we don't collect tax from hugely profitable corporations (GE, Exxon/Mobil, etc.) and we have an ongoing corporate bailout that is somewhere between $5-8 trillion (so far). Bush's $2.8 trillion in tax cuts for the super rich certainly didn't help.

It's a spending problem because we don't have revenue.

It's a revenue problem because there is too much spending.

It's not one or the other, it's both. We need to cut spending AND raise taxes. Spending cuts should start with ending the wars in Iraq and Afghanistan and slashing the US military budget. Raising taxes should start with eliminating corporate welfare and the loopholes that allow corporations (and the rich) to avoid taxes.

And we should absolutely rescind the Bush tax cuts, which were enacted in wartime, no less, in theory at least a time of national sacrifice (unless you're rich, of course).

Spending cuts that negatively effect jobs and the quality of life, health and education should be last on the list, not first.

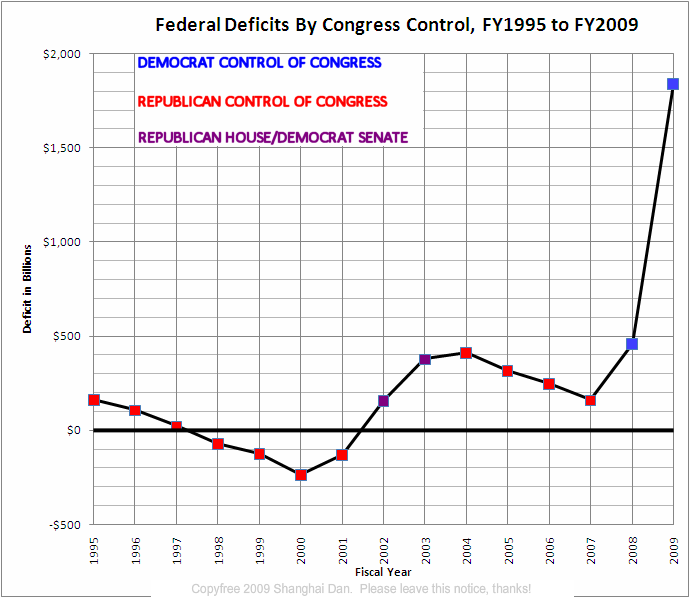

This should put a dent in your "Bush's Fault" theory.

National debt by U.S. presidential terms - Wikipedia, the free encyclopedia

Partially correct. We had a deficit before, we've had 10 years ($3 trillion so far) of wars, we don't collect tax from hugely profitable corporations (GE, Exxon/Mobil, etc.) and we have an ongoing corporate bailout that is somewhere between $5-8 trillion (so far). Bush's $2.8 trillion in tax cuts for the super rich certainly didn't help.

It's a spending problem because we don't have revenue.

It's a revenue problem because there is too much spending.

It's not one or the other, it's both. We need to cut spending AND raise taxes. Spending cuts should start with ending the wars in Iraq and Afghanistan and slashing the US military budget. Raising taxes should start with eliminating corporate welfare and the loopholes that allow corporations (and the rich) to avoid taxes.

And we should absolutely rescind the Bush tax cuts, which were enacted in wartime, no less, in theory at least a time of national sacrifice (unless you're rich, of course).

Spending cuts that negatively effect jobs and the quality of life, health and education should be last on the list, not first.

You must have missed that the nation had it's highest increase of revenue in history between 2003-2007. The Bush tax cuts worked!

www.washingtontimes.com/news/2010/feb/3/bush-tax-cuts-boosted-federal-revenue/

No, Bush's spending is what caused the deficit. Revenue for 2003-2007 was the highest in U.S. History. It's not a revenue issue we have it's a spending problem.

LOL, you made my argument for me. Thanks!

increase in debt as % of GDP

Clinton 1st term -0.7%

Clinton 2nd term -9%

Bush 1st term +7.1%

Bush 2nd term +20%

You chart shows how every Democratic president since (and including Carter) has lowered the debt/GDP percentage while every Republican president has increased it.

its not the president, its congress

How many Democratic spending bills did Bush veto?

We've been tracking upcoming products and ranking the best tech since 2007. Thanks for trusting our opinion: we get rewarded through affiliate links that earn us a commission and we invite you to learn more about us.